Yeah, I don’t know how much this applies outside the US.

The baby boomer generation was born during a time of relatively strong labor movements and a pretty strong industrial base across what is now the rust belt. Beginning in the late 70s/ early 80s (maybe even before that) you begin seeing de-industrialization all over the country. In simple terms, labor got too powerful as a result of wwii (hence why the mob infiltrated them - like ISIS the mob is not actually outside the law as much as people think, in fact look at how little you hear about them now, they went underground because they successfully played their role to co-opt the unions).

With the de-regulation which accompanied Reagan you see a massive boom of the Merger and Acquisition and private equity segments of finance. What this represents is a massive consolidation of american businesses, decrease in employment (permanently in many cases), and general decrease in the quality of life (when supply is constricted on a good with inelastic demand, food, housing, oil, the price goes up). A key element of financializing the economy (turning a productive economy into an extractive one) is to commodify everything - so if someone owns something the best thing to do is to find a way to take it from them then lease it back to them, or finance their purchase of another asset, the more the asset the rent or purchase from you costs the more money you make. If the demand for that good is inelastic and you prevent the government acting on behalf of the individual you are turning into a landlord of sometimes enormous scale.

The thing (they see it as a commodity) with the most inelastic demand is housing and so they drive the price up by limiting supply, bidding up the market, and most importantly CORNERING the market. therefore the price of homes goes up no matter what. Now the reason I say this sows inter-generational resentment is because they have aligned the interests of the homeowning older generation with the interests of the financial class. So when the young people wish for a crash in the price of housing they are seen as mean by their own parents and so forth. Therefore, it is fair to say that driving up the price of housing is yielding atrocious macroeconomic results for the general populatoin but most middle class homeowners are quite happy with it. This is a major reason boomers are so out of touch… they don’t need to be in touch, their home is their savings.

So when you tell a homeowning boomer " you have nothing to lose but your chains" that actually doesn’t make sense to them. They feel like they’re rich (they aren’t because housing is only worth a lot because of the market which is highly highly manipulated). So this is funtionally a bribe from the financial class for them to look the other way as they de-industrialize the US and ruin the economy. Understanding real estate is key to understanding modern america imo.

Monetary inflation also plays a role, but this is how real estate ties in. In fact the entire consolidation of the american agriculture, retail, oil, etc sectors can be seen as having been subsidized by the government in various ways.

Also, 80% of bank loans are issued to purchase existing property (that is, not productive debt) which means that the higher real estate prices go, the more the banks collect in fees, mortgages, etc. Absolutely insanely parasitic state of affairs.

1870 to today https://voxeu.org/article/home-prices-1870

Muhammad Saeed al-Sahhaf was the Iraqi Information Minister during the 2003 US invasion. He became famous, ludicrous, for making claims about the US activities that were the exact opposite of the truth, such as “Shock and awe? It seems that we are the awe on them. They are suffering from the shock and awe.” https://www.urbandictionary.com/define.php?term=Baghdad Bob

This is a common expression in the military for propagandists who get so far out of touch that they end up looking ridiculous. A lot of that on western media these days. For the economy as well as the war in Ukraine.

Real estate is central to the modern financial capitalist system. The real estate bubble is essentially a way to increase the profits of lending (in the form of interest, capital gains, and processing fees) while doing something which requires literally no production.

This has also been an excellent tool to sow inter-generational resentment among the proletariat.

The US defense budget is an inefficient nightmare. There is so much bloat, cash being pocketed, contract steering, useless R&D that will yield nothing, and general price gouging by the contractors that our budget probably doesn’t get us much more if anything more than the Russian budget. In 2016 the boston globe found 80% of generals took posts in defense contracting and consulting after retirement. This means that literally every contract they signed off on while an officer they were at least considering going to work for the firms afterward. My father who worked with the military said that it was more like 90% and that the ones who don’t directly go to work for contractors end up working on wall street or in think tanks designed to fuel the defense industry. 20% of the defense budget goes to five firms…

The biggest issue my father flagged for me was culture. We have a military culture that is increasingly un-meritocratic and generally speaking leads to GROSS incompetence, mistrust, and misbehavior. Furthermore, the officer corps is (1) arrogant as all fuck, and/or (2) stupid. The same discontent we see among civilians is present among the enlisted men and women, just even more to the right unfortunately.

I am not advising any particular action and there is no conflict of interest in my comment. I am just saying that people should take off their “judgment goggles” when assessing financial vehicles. Also, there is no way you read my whole comment that fast

All of capitalism is a ponzi scheme. If someone tells you “I made money working at this firm and so you should consider applying” that doesn’t automatically mean they are trying to sell you on a ponzi scheme.

I recommend you reassess your analogical thinking - definition of analogy “: a comparison of two otherwise unlike things based on resemblance of a particular aspect”

What you are describing is volatility and that is how money is made by the big firms which use algorithms. People like to shit on crypto culture (I know I do) but crypto is not just a bunch of libertarian fintech bros. It is primarily massive institutions who are pumping and dumping, money laundering, and bypassing all sorts of regulations all the time. (and the CIA is massively into crypto) Like in the stock market, retail makes up a small percentage of trades and is constantly having their emotional responses weaponized against them. Twitter should be seen as a hopium factory.

I make my living investing and consulting. My advice is do NOT read corporate media for investing advice/insight, read it only to get insight onto what the “narrative” is at that time. You want to look at forums and do your own research. I had a particular education and work experience which made me suited to this but anyone can learn it. Just always be a little bit paranoid.

AS far as your original comment “Is this more substantial than the countless previous crashes/downturns?” I would say yes. The interplay between crypto as a money creation/laundering scheme and the stock market has been enormous these last two years. The flow between the “covid” Quantitative easing (money printing) and the crypto, housing, bond, and stock markets bubbles is not just in one direction. Many people think “the fed gave wall street money and they put it into the market and generated returns.” it is way more complex than that. Wall street sets up hidden, off the books, and regularly illegal vehicles to manipulate values, overleverage themselves, run pump and dump schemes and suck the money of retail investors, then turn around and make fat fees all along the way. The short version is that the whole is greater than the sum of it’s parts.

As far as crypto goes I would recommend reading this. [https://crypto-anonymous-2021.medium.com/the-bit-short-inside-cryptos-doomsday-machine-f8dcf78a64d3 ](It is anonymous but the logic is good, the data within is independently verifiable, and it tracks 100% with my knowledge of the culture of finance)

If you want more reading on the stock market I recommend Wall Street on Parade, medium, and fringe forums. To get really good insight on finance you have to be happy going to places where like 100 people have read this article. Many of the more mainstream alt accounts (youtubers for example) work with big firms whose interests are opposed to yours. You have to be extremely paranoid about the conflict of interests of the person you are reading/listening to.

Edit: removed my first paragraph as it was superfluous and incited judgment (tl;dr I made money in crypto by understanding it’s pitfalls going in and knowing crypto bro culture was largely marketing and knowing how retail is being played by institutional investors) just trying to engage in good faith discussion about something I know a lot about.

The economy slowing down will have a major impact on this Second hand clothing sales are increasing big time and will only continue to increase

here. found a book to point you towards. https://www.amazon.com/Who-Financed-Hitler-Funding-1919-1933/dp/0671760831

I had a hard time finding a non conspiracy theory book, because I know what I know from someone who worked on wall street, not from reading. I would bet money that the firms I am thinking of are mentioned by name in this book.

Also take a look at https://en.wikipedia.org/wiki/Ivy_Lee

Generally though, these are the types of secrets that ruin careers… or worse.

Good video comrade, working through it now.

Just want to say that it’s my opinion that Tesla is the largest, most patient pump & dump of all time. In fact, I think it is the most elaborate bust out + wall street financial engineering of all time. He’s already sold a huge amount of his shares.

Bust out depicted in Goodfellas

Edit: also, Musk is very likely an asset running a front company https://en.wikipedia.org/wiki/Michael_D._Griffin#Career

Maybe I don’t need to tell you guys this, but I will anyway.

The Nazis (the real hidden ones who funded hitler from the Anglosphere) won world war two. There were very real reasons as to why Stalin was the one who had to insist on having the Nuremburg trials - which some American prosecutors themselves called shams!

There’s always a reason. Pretextual reasons for stocks falling abound - Wokeism, password sharing policy pissed people off, etc. but those are always either marginal or completely irrelevant.

Netflix is likely the target of a short attack where their stock price is undermined via financial engineering, in order to reduce their ability to fundraise and make it easier to acquire them which clears the way for a monopolization of the market. Wall street wants 2 things (domestically) - to have a portion of every dollar spent go to them via a monopoly on everything (amazon = CHOAM from Dune) and a portion of every dollar earned earmarked for them via getting every american into debt.

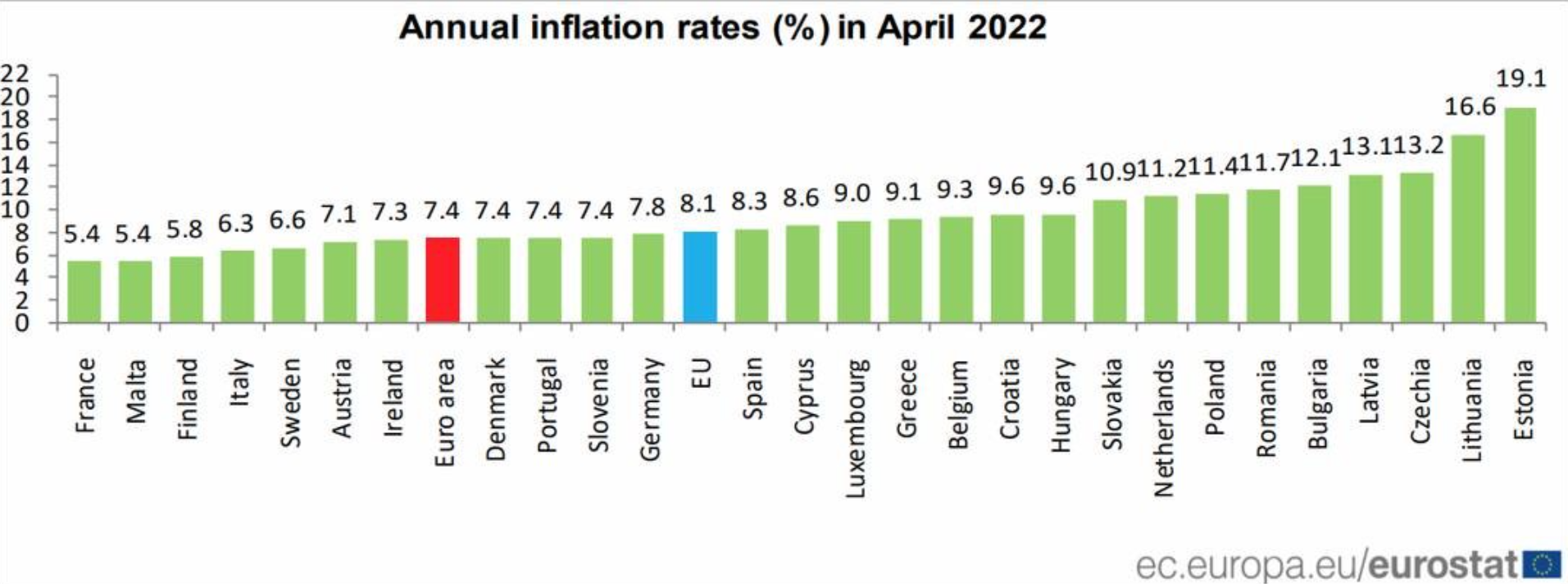

Also, the decrease in subscribers is very real and is likely the result of no specific decision but of the fact that inflation is at all time highs (I think we are likely over the levels of the 1970s) and wages are still stagnating. People are having to make decisions they didn’t have to make a couple years ago. Welcome to the depression comrades.

Edit: the reason I think they are being shorted is because sentiment does not evaporate that quickly on an established company like netflix and there are too many parties who would benefit from their demise.

Capitalism creates a society wide potemkin village. and even when you live in capitalism it is an ever-present veneer.